Bank of America Check Credit Card Application Status

Organisation : Bank of America

Facility Name : Check Credit Card Application Status

State/Province : All States

Country : United States of America (USA)

Website : https://www.bankofamerica.com/credit-cards/application-status-center/

How to Check Bank of America Credit Card Application Status?

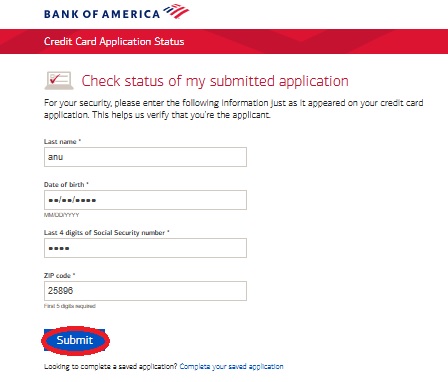

For your security, please enter the following information just as it appeared on your credit card application. This helps us verify that you’re the applicant. To Check Credit Card Application Status follow the below steps,

Steps :

Step-1 : Go to the link https://secure.bankofamerica.com/apply-credit-cards/public/application-status/

Step-2 : Enter Last name

Step-3 : Enter Date of birth MM/DD/YYYY

Step-4 : Enter Last 4 digits of Social Security number

Step-5 : Enter ZIP code (First 5 digits required)

Step-6 : Click on “Submit” Button.

Related / Similar Facility : USAA Bank How to Apply For Personal Loan?

FAQ on Bank of America Credit Card

What’s a cash credit line?

The cash credit line is a portion of the total credit available on your credit card, and is the maximum available credit for Bank Cash Advance transactions. Generally, Bank Cash Advances consist of ATM Cash Advances, Over the Counter (OTC) Cash Advances, Same-Day Online Cash Advances, Overdraft protection transfers (if you have linked your credit card as a backup account for Balance Connect® for overdraft protection), Cash Equivalents and applicable transaction fees.

How do I request a credit line increase?

If your account is eligible to request a credit line increase online, you’ll be able to make the request by signing in to Online Banking, selecting your credit card account, then select the Request a credit line increase link under Card Details in Account Summary. If your account is not eligible to request an increase online, please call the number on the back of your credit card.

What does “cash credit line available” mean?

Your cash credit line available is the amount of money on your credit card that is currently available for you to use for bank cash advance transactions. Keep in mind that any bank cash advance transactions you have made but have not yet been processed should be subtracted from your cash credit line available.

What happens if I go over my cash credit line?

If you exceed your cash credit line, you will not be able to make any more Bank Cash Advance transactions until you have paid your balance below the cash credit limit. There is no account penalty if you go over your cash credit line. Exceeding the cash credit line will not result in a fee or a higher APR, but you may experience declined transactions.

How do I know the amount of my cash credit line?

You can view your cash credit line on your statement, in Online Banking on your credit card Account details page or by calling customer service.

How do I request my credit card PIN?

To request your credit card PIN: Log in to Online Banking. You may also request your PIN using our Mobile Banking app or by calling the number on the back of your card.

How do I request a new/replacement credit card?

You can easily request an additional credit card or a replacement credit card on our website or on your mobile device.

On our website :

Log in to Online Banking and select the Order a new or replacement card link.

Not an Online Banking customer? Enroll in Online Banking today

On your mobile device :

Log in to the Mobile Banking app and select your credit card account, then scroll to the Card Management section and select the Replace Credit Card link.

You can also tap the Erica icon and say, “I need to replace my credit card” then follow the instructions (if you prefer, you can also type your message to Erica).

What are some tips for using an ATM in foreign countries?

ATMs can be used to get foreign currency while traveling and may save you money when compared to buying currency at exchange rate booths. Despite the advantages, you need to be prepared for special circumstances that can arise when using an international ATM. Here are a few tips to help you on your way:

Check the network: Check your card’s network. Cards in the Cirrus and Maestro networks often feature ATMs with easy-to-read instructions in English. Bank of America belongs to the Global ATM Alliance.

Research the country: There are some countries where ATM transactions are blocked. Please research the country to verify whether you will be able to use your credit card.

Understand the types of fees charged: Fees may be incurred for using the ATM and there may also be fees for currency conversion and cash advance. It is usually better to make fewer larger transactions instead of multiple smaller ones.

Make sure your PIN is valid: Some ATMs only allow 4-digit PINs. If your current PIN is longer than 4 digits, you may need to get a new PIN before you start your trip.

Have a backup plan: Some ATMs limit your access to a primary checking account, so have an alternative means of making purchases such as using foreign currency, traveler’s cheques or a debit card.

Bank of America Customized Cash Rewards Credit Card

$200 online cash rewards bonus offer and 3% cash back in the category of your choice

** 3% cash back in the category of your choice, automatic 2% cash back at grocery stores and wholesale clubs (on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter) and unlimited 1% cash back on all other purchases Calculate rewards

** Choose which category you want to earn 3% cash back in: gas and EV charging stations; online shopping, including cable, internet, phone plans and streaming; dining; travel; drug stores and pharmacies; or home improvement and furnishings.

** To change your choice category for future purchases, you must go to Online Banking, or use the Mobile Banking app. You can change it once each calendar month, or make no change and it stays the same.

** 0%† Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the intro APR offer ends, a Variable APR that’s currently 19.24% to 29.24% will apply.

** 3%† Intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all future balance transfers is 4%.

** Bank of America Preferred Rewards® members earn 25%-75% more cash back on every purchase. That means the 3% choice category could earn 3.75% – 5.25% and the 2% at grocery stores and wholesale clubs could earn 2.50% – 3.50%, for the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter, and the 1% for all other purchases could earn 1.25% – 1.75%. Not enrolled? Learn more about Preferred RewardsCash Rewards.

** This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. You can take advantage of this offer when you apply now.